Risk and Return

Risk and Return are related - by allocating capital to higher risk investment assets, investors can expect a higher return to compensate for the risk being taken. Equally, capital invested in lower risk assets is to be expected to generate lower returns.

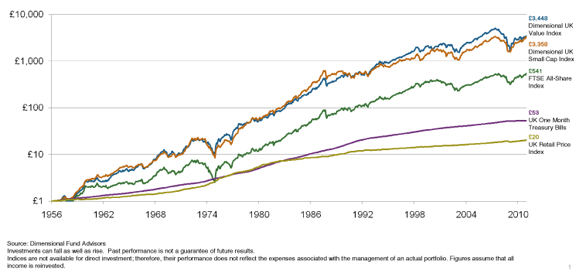

Jessop tilts the equity element (i.e. higher risk assets) of its portfolios towards small and value companies as these types of company have a higher expected return than the broad equity market due to a risk premium for investing into such companies.

Click on the graph to see the historic performance of small and value companies against other asset classes.

Charles Ellis, a member of the Board of Directors of Harvard Business School and a Trustee of Yale University, where he serves on the investment committee, talks of the value of financial advisers, the basic principles of investing and understanding our own emotions when it comes to investing.

* Jessop Financial Planning cannot be held responsible for the content of any third party material